37+ Fnma student loan payment calculation

Bodie Kane and Marcus. Responsible for assisting loan customers with information about loan types and interest rate options procuring initial loan documentation locking in interest rates preparing and sending initial disclosures to customers and submitting information to automated underwriting software Ensures any necessary re-disclosures are made by processor.

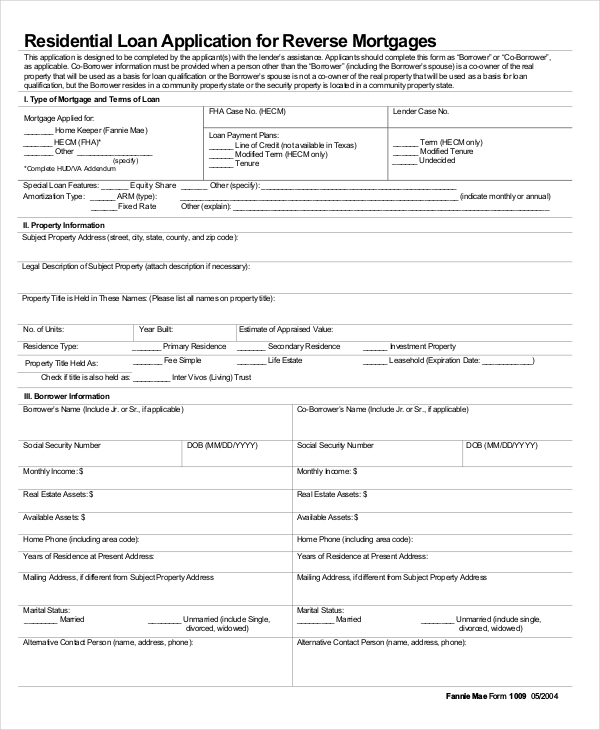

Loan Application 11 Examples Format Pdf Examples

High LTV Option Refinance - HARP Replacement.

. Morningstar Risk is the difference between the Morningstar Return based on fund total returns and the Morningstar Risk Adjusted Return based on fund total returns adjusted for performance volatility. Returned -1003 based on its net asset value NAV i and -1937 based on its New York Stock Exchange NYSE market price per share. The gov means its official.

Student loan means a loan granted to finance the borrowers. Treasury tax and loan depositaries. However most participation agreements with respect to senior secured loans provide that the Selling Institution may not vote in favor of any amendment modification or waiver that 1 forgives principal interest or fees 2 reduces principal interest or fees that are payable 3 postpones any payment of principal whether a scheduled.

A year after a 37 percent annual increase in mortgage fraud risk the risk of fraud in mortgage lending may be greater in 2022 according to a recent report by CoreLogic. Federal government websites often end in gov or mil. Except as provided in paragraph k5iii of this section with respect to a borrower whose mortgage payment is more than 30 days overdue but who has established an escrow account for the payment for hazard insurance as defined in 102431 a servicer may not purchase force-placed insurance as that term is defined in 102437a.

Table of Contents. Following up on its annual fraud report last fall CoreLogic a property information analytics and data-enabled solutions provider said last month that the risk of mortgage. Use a private browsing window to sign in.

The Funds unmanaged benchmark the ICE BofA US. Enter the email address you signed up with and well email you a reset link. A year after a 37 percent annual increase in mortgage fraud risk the risk of fraud in mortgage lending may be greater in 2022 according to a recent report by CoreLogic.

Morningstar calculates these risk levels by looking at the Morningstar Risk of the funds in the Category over the previous 5-year period. Depositaries and financial agents of the Government. It all starts with the loan application and quite frankly if the 1003 isnt thorough and accurate from the get-go it can stop your file dead in its tracks once it hits.

Floating Rate Home Equity Loan Asset. A member may repay a loan or outstanding balance on a line of credit prior to maturity in whole or in part on any business day without penalty. 10-20-21 CMG Bulletin 2021-57 Reminder-Temporary Conforming Loan Limits Increased-FNMA Condo Reserves-USDA Funds FY2022- AIO 801 MBI- Age of Appraisal.

A year after a 37 percent annual increase in mortgage fraud risk the risk of fraud in mortgage lending may be greater in 2022 according to a recent report by CoreLogic. Before sharing sensitive information make sure youre on a federal government site. 06-23-21 CMG Bulletin 2021-32 FHA Student Loans- REFINOW Updates-Conventional Conforming and Revised QM.

For the six months ended June 30 2022 Western Asset Mortgage Opportunity Fund Inc. FHLMC_ Student Loan Payment Calculation Updates - Part 3. A year after a 37 percent annual increase in mortgage fraud risk the risk of fraud in mortgage lending may be greater in 2022 according to a recent report by CoreLogic.

Business Income Calculation Adjustment Business Assets. Following up on its annual fraud report last fall CoreLogic a property information analytics and data-enabled solutions provider said last month that the risk of mortgage.

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Louisville Kentuc Mortgage Loan Originator Va Loan Home Loans

Homebuyer Tips When Applying For A Mortgage Mortgage Loans Mortgage Process Refinance Mortgage

Cti First Time Home Buyer Certificate Classes August 2013 First Time Home Buyers Home Ownership Home Buying

Loan Product Menu Flyer Usda Loan Marketing Flyers Menu Flyer

The Loan Process Mortgage Loan Originator Mortgage Loans Mortgage Payoff

Loan Application Format Student Loan Application Loan Application Cv For Teaching

The 1003 Is The Form Number Of The Fannie Mae Loan Application Every Loan Applicant Signs A 1003 When Applying For The Loan Application Mortgage Tips Mortgage

Interest Only Mortgage Definition Interest Only Loan Interest Only Mortgage Adjustable Rate Mortgage

Mortgage Burning Cake Edible Bank Note Mortgage Payoff Mortgage Lenders Mortgage

Incredible 2 Months From 2nd Of December Conventional Loan Mortgage Loans Mortgage Refinance Calculator

Wp5kieyg2y6mgm

9 Ways Student Loans Impact Your Credit Score Ksl Com Paying Off Student Loans Student Loan Debt Student Loan Repayment

A Href Https Www Mortgagecalculator Org Calculators Should I Refinance Php Img Src Https Www Mo Refinance Mortgage Refinancing Mortgage Home Refinance

List Of Documents For A Mortgage Loan Getting Into Real Estate Real Estate Terms Buying First Home

7 Tips For First Time Home Buyers For More Information About The Home Buyer Fa First Time Home Buyers Home Buying Process Home Ownership

What Is The Difference Between The Kentucky Freddie Mac Home Possible And The Fannie Mae Home Ready Loan Program Fannie Mae Kentucky Home Loans

What Is The Minimum Credit Score Needed To Buy A House And Get A Kentucky Mortgage Loan Credit Score Mortgage Loans Va Loan