24+ kentucky pay calculator

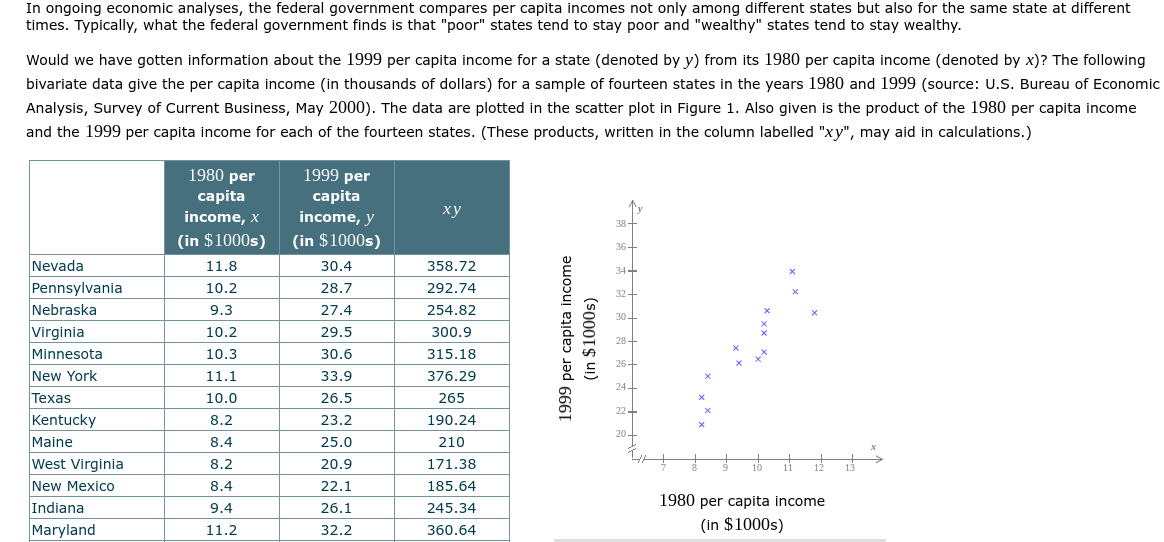

Web Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Web Kentucky tax year starts from July 01 the year before to June 30 the current year.

Equivalent Salary Calculator By City Neil Kakkar

Web This calculator helps you determine the gross paycheck needed to provide a required net amount.

. Web How to Calculate Your Paycheck in Kentucky. All you have to do is enter each employees wage and W-4 information and our calculator will process their gross pay deductions and net. Hourly Salary Take Home After Taxes SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Web Free Paycheck Calculator. Then enter your current payroll. This income tax calculator can help estimate your.

The Kentucky minimum wage is 725 per hour. Web Use our free Kentucky paycheck calculator to determine your net pay or take-home pay by inputting your period or annual income along with the pertinent. Examples of payment frequencies include biweekly semi-monthly.

Your average tax rate is 1167 and your marginal. Web The process is simple. Are you a resident of Kentucky and want to know how much take-home pay you can expect on each of your paychecks.

Web The state income tax rate in Kentucky is 5 while federal income tax rates range from 10 to 37 depending on your income. Web The Kentucky Salary Calculator allows you to quickly calculate your salary after tax including Kentucky State Tax Federal State Tax Medicare Deductions Social Security. Web The Salary Calculator converts salary amounts to their corresponding values based on payment frequency.

Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Kentucky. Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Overtime must be paid at 1 ½ times the hourly rate for hours worked over 40 in a week. Web The basic benefit calculation is easy it is 11923 of your base period wages. Web Kentucky Paycheck Calculator.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Well do the math for youall you. Just enter the wages tax.

However below are some factors which may affect how you would expect the. First enter the net paycheck you require. For example if an.

Web How to calculate annual income. Web Kentucky Income Tax Calculator 2022-2023 If you make 70000 a year living in Kentucky you will be taxed 11493. Web This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate.

Falkland Chase Apartments 8305 16th Street Silver Spring Md Rentcafe

Breakbulk Europe 2017 Event Guide By Breakbulk Events Media Issuu

Kentucky Paycheck Calculator Tax Year 2023

Solved In Ongoing Economic Analyses The Federal Government Chegg Com

Kentucky Paycheck Calculator 2022 2023

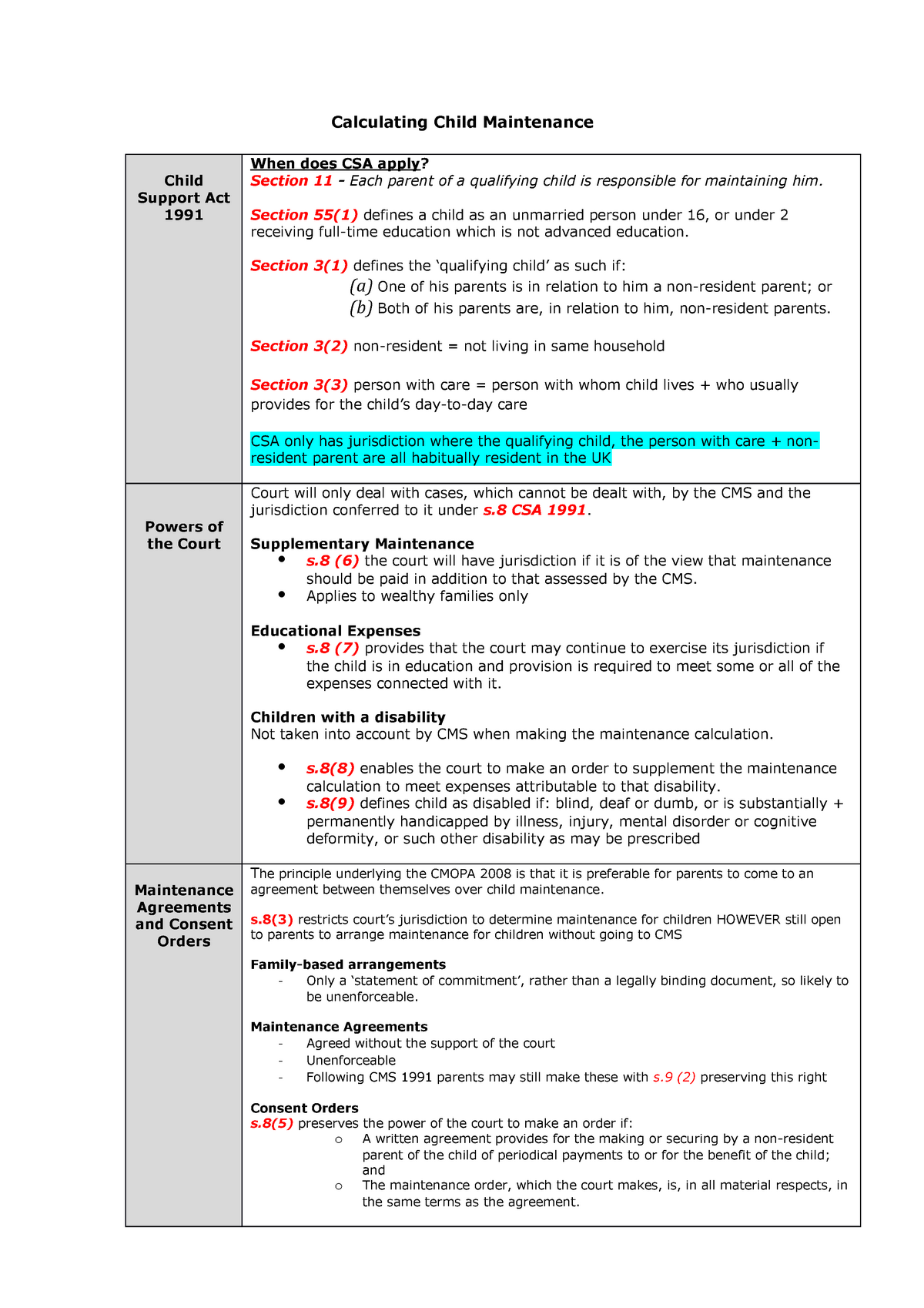

Revisions Part 2 Intellectual Property Revision For Exams Calculating Child Maintenance Child Studocu

Take Home Pay Calculator Apk For Android Download

Disaster Risk Analysis Part 2 The Systemic Underestimation Of Risk

Kentucky Paycheck Calculator Smartasset

Top 5 Best Salary Calculators 2017 Ranking Top Net Gross Salary Calculators Advisoryhq

2810 George Washington Memorial Hwy Hayes Va 23072 Mls 10270053 Howard Hanna

Disaster Risk Analysis Part 2 The Systemic Underestimation Of Risk

0 Donovan Rd Bucksport Me 04416 Mls 1517554 Redfin

Medium Duty Trucks For Sale In Washington 147 Listings Truckpaper Com Page 2 Of 6

Zrb0ws1lzlnznm

1943 Stoney Point Road Cumming Ga 30041 Compass

6650 E Center Rd Hastings Mi 49058 Zillow